Before examining that first accusation, we need to define our terms.

Defining the terms

The U-3 rate (the one that makes the news) includes those over 16 years of age, who aren't institutionalized (which means not in a nursing home, prison, or the military), who are available for work, and who have looked for a job in the last four weeks.

The U-6 rate includes everyone in the U-3 number, plus the underemployed and the discouraged workers.

The "underemployed" are those who are working part-time who are available to work full-time, and who want to work full-time.

The "discouraged" are those who haven't actively looked for work in the last year.

So it's to be expected that the U-6 rate will always be higher than the U-3 rate.

Examining the data

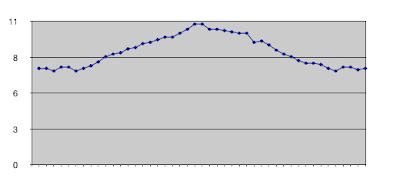

The U-3 number is dropping. No argument there. It peaked at 10% in October 2009, and has since dropped to 7.8%. As I pointed out previously, that 7.8% is lower than after President Obama's first full month in office, which makes President Obama's record on unemployment better than any of his three Republican predecessors.

The contention of the conservatives is that the U-3 number is only dropping because more and more people are getting discouraged and not looking for work. If that's the case, we should see that the U-6 number is rising as more and more people stop looking for work or accept part-time jobs.

But that isn't the case. The U-6 number hit its peak (17.2%) in October 2009 and, like the U-3 number, has been dropping steadily since then. It's now down to 14.7%.

Here's a graph of the U-3 (blue) and U-6 (green) numbers since February 2009 (President Obama's first full month in office)

As the data and chart clearly show, the U-6 unemployment rate is higher than the U-3 unemployment rate. That's to be expected. The chart also shows that the U-6 number, although not dropping as fast as the U-3 number, is nonetheless dropping.

So it appears that the claim that the U-3 rate is dropping because more and more people are discouraged is, at best overstated, and at worst completely false.